Americans rack up $45B worth of medical debt in collections

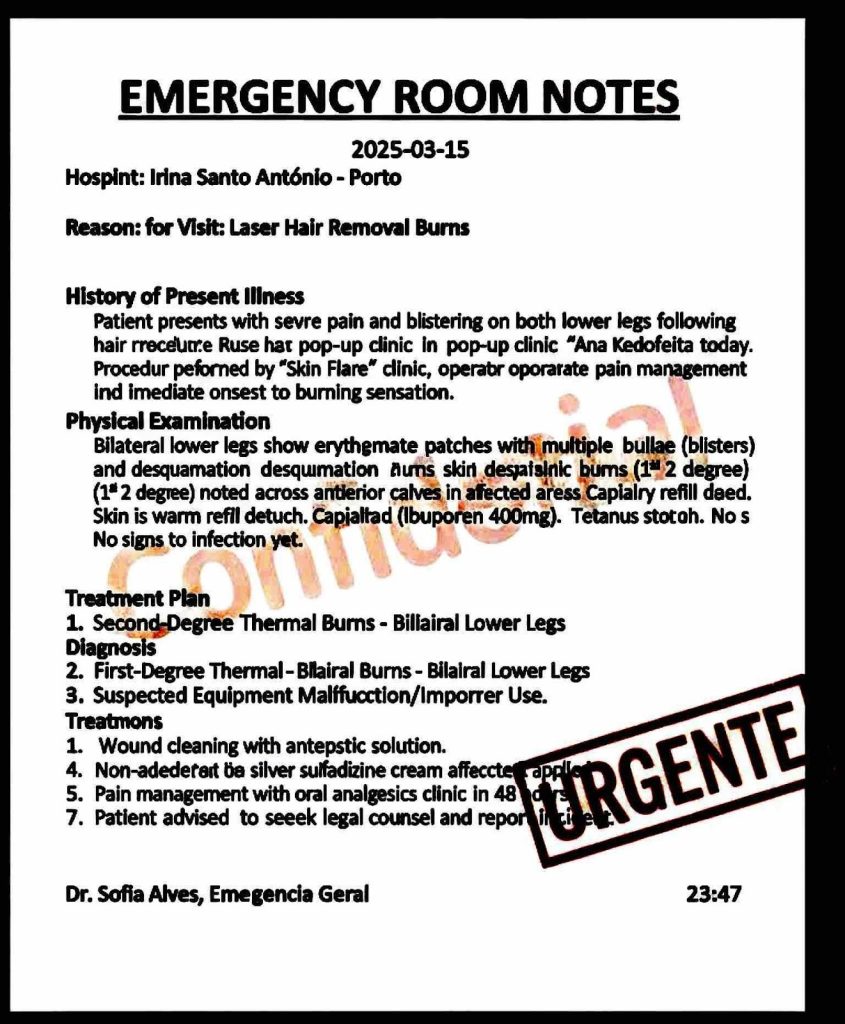

Cathy Munzer is a single mother who lost her health insurance during the coronavirus pandemic. Munzer, who was a yoga and fitness instructor at two major gyms in Manhattan, was laid off in March and has struggled to find work.

Now her medical bills are in collections after she fell behind on payments from being treated in an emergency room for kidney stones.

After that, she began paying $200 per month for health coverage through Fidelis Care, a New York-based health insurance company, but it came with a $2,000 deductible. That’s increased her medical expenses further due to out-of-pocket costs. Every time she has visited a doctor since then she’s paid $150 per visit, she says.

“This is going to bankrupt me. My biggest fear is depleting my savings,” says Munzer, 53, who’s also been putting off oral surgery because her insurance won’t cover it. “What happens when unemployment runs out? How will I survive?”

Can stocks predict election winners?: The market is usually a good predictor of presidential winners, but this year is different

A house divided: As millions of Americans face evictions, others buy dream homes during COVID-19

Cathy Munzer, a yoga and fitness instructor, was laid off in March from two major gyms in Manhattan.

Medical debt is piling up as millions of unemployed Americans struggle to stay afloat after losing their health-insurance coverage following a historic wave of layoffs this year.

Consumer finance company Credit Karma conducted an analysis of nearly 20 million members in the U.S. and found that they have a total of $45 billion of medical debt in collections, which averages to about $2,200 of debt per member.

“This is a lot of money when you consider nearly half of Americans don’t have $400 saved in case of an emergency,” says Colleen McCreary, chief people officer at Credit Karma. “What’s worse, this number is expected to rise in the coming months as Americans begin sorting out their finances in the aftermath of the pandemic.”

Unforeseen medical expenses can drive people from the doctor to the debt collector. A separate survey during the pandemic shows that 56% of U.S. adults had medical debt sent to collections and nearly two-thirds owe under $5,000, while 5% owe more than $50,000, according to a Debt.com survey conducted from June 17 to July 6.

Hospitalization accounted for a quarter of the medical debt, the study showed, followed by diagnostic tests for X-rays, MRIs and lab fees (22%), emergency room visits (19%) and doctor visits (15%).

“We often hear horror stories about chronic conditions or complicated surgical procedures that drive up medical bills to shocking levels,” Don Silvestri, president at Debt.com, said in a note. “Even smaller amounts can overwhelm your income and savings. The result is a debt collector pursuing you.”

Two-thirds of those who file for bankruptcy cite medical issues as a factor, according to a study last year in the American Journal of Public Health that included Americans who had filed for bankruptcy between 2013 and 2016.

For those struggling to pay medical bills, here are ways to minimize the financial damage:

How to avoid having medical debt sent to collections?

The best practice is to engage with a medical provider and insurance company early before they send an account into collections. Some consumers may not realize that they can negotiate with medical providers to find the best ways to pay off their debt, experts say. In fact, about 60% of respondents in the Debt.com survey didn’t try to negotiate medical debt payments or their bill, whereas nearly 35% did. Just under 5% used a medical billing advocate.

What actions should you take once an account goes to collections?

First, verify that the medical bill is legitimate to avoid scammers. A collection agency is required to send you a written explanation of your bill within five days of your requesting it, according to credit reporting agency Experian. If there are errors or if the bill has been sent to collections in error, dispute it or contact the medical provider and insurance company to resolve the issue. Collection agencies can provide repayment plans and might be willing to accept a reduced payout, Experian says.

How does medical debt sent to collections affect credit scores?

There’s a 180-day waiting period before unpaid medical debts can appear on consumers’ credit reports, according to Experian. If sent to collections, medical debt can have a negative effect on credit scores and can remain on a report for up to seven years.

Newer credit scoring models including FICO 9 and VantageScore 4.0 weigh medical collections less than other types of collections so that they don’t impact a person’s credit score as much. Not all creditors, however, use these new scoring

models, so medical collections could still hurt your ability to get credit in the future.

If a consumer finds themselves in a situation where they are struggling to pay down multiple forms of debt, including credit card or loan debt, they may want to consider addressing those payments first as they come with much higher interest, says McCreary.

Avoid using a credit card to pay off medical debt, experts say. Because medical debt typically doesn’t come with late fees and requires little to no interest, swapping it out with high-interest credit card debt isn’t the best financial move. A higher balance means a higher credit utilization ratio, which will negatively impact your credit.

What health care options exist for those who have lost coverage?

For those and their spouses who have lost health insurance through a job loss, look at options for purchasing another health insurance plan, says McCreary.

COBRA is a federal law that allows Americans to continue their previous employer’s health coverage plan for up to 18 months after they lose their job. The coverage and provider network remains the same, but participants will be charged a premium in exchange for their coverage. But some could be hit with a hefty bill since their employer is no longer required to contribute to their premium.

Unemployed Americans have 60 days after the loss of employment to decide if they want to elect to take COBRA coverage.

What payment options are available for medical bills?

There are different payment options to consider, but the most common method is to negotiate a payment plan with your medical provider, but be sure to inquire about potential associated fees to ensure it’s an affordable option, McCreary explains.

Financial assistance. Hospitals sometimes have financial-assistance programs to help patients cover the care that they need. The qualification criteria vary but these programs usually consider income, assets, and whether the received care or treatment is a medical necessity, says McCreary.

Tapping into home equity. Because we entered 2020 with record-high levels of home equity, homeowners may want to look into home equity options like a HELOC of cash-out refinance, according to McCreary. But it could come with risk. HELOCs allow consumers to borrow money with a revolving line of credit against the equity of their home.

Medical loan. Medical loans may be unsecured personal loans, meaning they don’t require collateral, but applications for these types of loans focus on factors like credit history and income, so this option should be for those who are in stable financial situations.

This article originally appeared on USA TODAY: Unemployment: Americans face $45B worth of medical debt in collections